I am Stephen W. Dale and a board member of the Arc of California as well as the Trustee of the Golden State Pooled Trust and principal attorney at the Dale Law Firm. I want to take a moment and share with our community some changes in the laws concerning leaving property for the benefit of a child or grandchild with a disability, as well as some deadlines that may affect planning options.

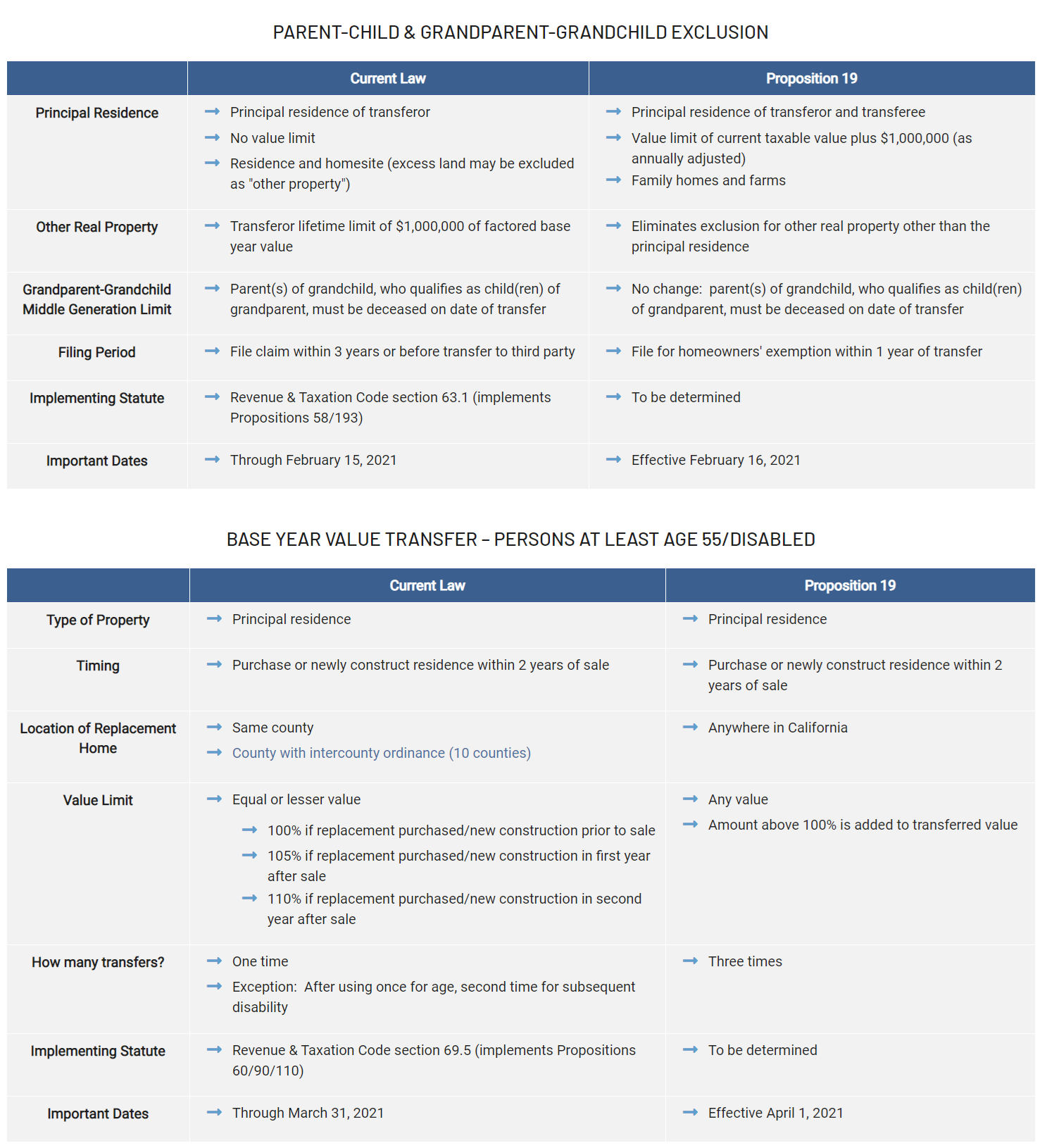

On November 3, 2020, California voters approved Proposition 19 which is constitutional amendment that limits who inherit family properties from keeping the low property tax base unless the home is the primary residence of the transferer and transferee. Proposition 19 also allows homeowners who are over 55 years of age, severely disabled, or victims of a wildfire or natural disaster to transfer their assessed value of their primary home to a newly purchased or newly constructed replacement primary residence up to three times. The new law will make important changes to two existing statewide property tax saving programs:

- Limits the parent-and-child transfer and grandparent-to-grandchild transfer exclusions effective 2/16/2021

- Expands programs for home transfer by seniors and severely disabled persons effective 4/1/2021

A concern for many parents and grandparents that intend to transfer property to a child or in specific situations a grandchild is that the new rules go into effect February 16th. It is important that parents or grandparents looking to leave real property to their child or grandchild to review these rules and if needed educate themselves whether it is prudent to make property transfers prior to that date.

A good source of information is the Board of Equalization (BOE) at https://www.boe.ca.gov/prop19 which includes the following tables that compare the current law with the pending changes.

Here is a link to a playlist of videos that I have created on with videos on Proposition 19 as well as other videos on housing issues for persons with disabilities. https://www.youtube.com/watch?v=IaLwIBK4TsI&list=PL5dEwlCC642rxNsNgJN6lU84s-VEb9IxW . another good source of materials is from the BOE which can be found at https://www.boe.ca.gov/serp.htm?q=Proposition+19 .

Families that should seriously review these laws and seek counsel are;

- Parents (and in limited situations grandparents) that plan on leaving property that is NOT the family residence for the benefit of their child with a disability.

- Parents (and in limited situations grandparents) that are looking to leave their family residence for the benefit of a child or grandchild where the value of the property is greater than the current tax base, plus$1,000,000.

- Parents (and in limited situations grandparents) who plan on leaving investment property for the benefit of their child with a disability.

Families should be aware that many estate planning offices are facing challenges right now because of the deadlines, as well as challenges because of COVID. Even so, these issues are very complex so best to talk with your tax and legal advisors to determine what is best for you.

The Arc of California is monitoring issues and welcomes your input. As the BOE makes clear, “At this time, there are still many uncertainties surrounding the implementation of Proposition 19, as the language does not address all issues. These issues will need to be resolved through future legislation. Once this implementing legislation has been enacted, we will issue future guidance on the matter.” https://www.boe.ca.gov/proptaxes/pdf/lta20061.pdf

Stephen W. Dale, LL.M

Trustee – Golden State Pooled Trust www.gspt.org